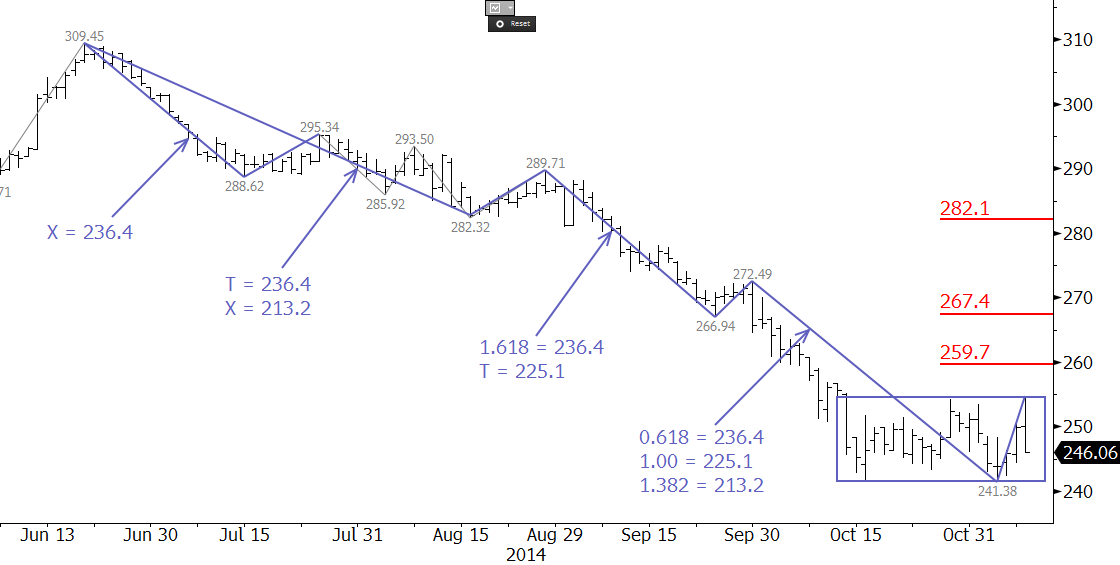

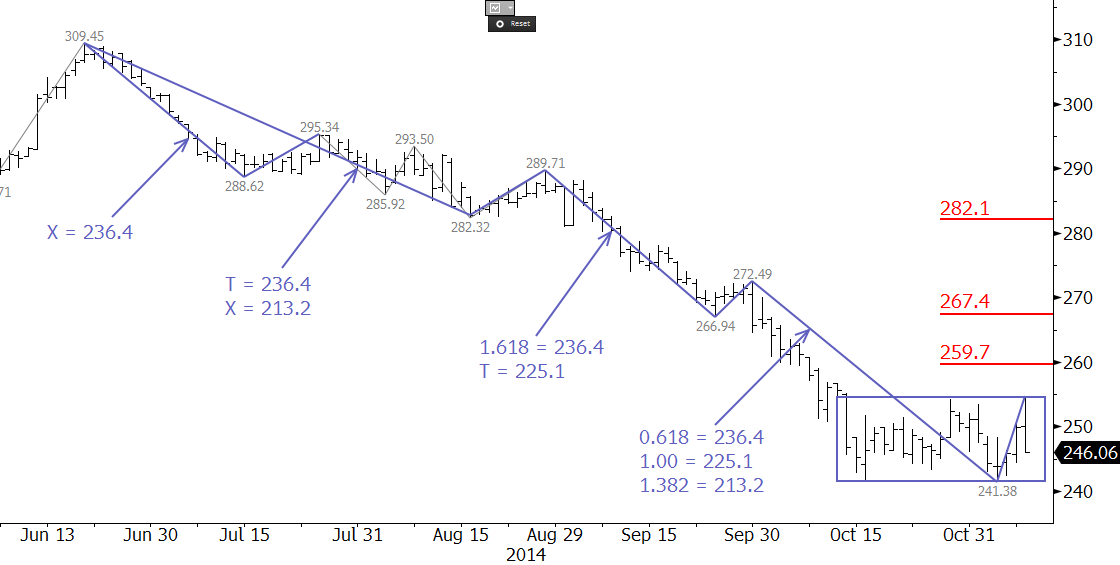

December 2014 NY Harbor ULSD futures have formed a rectangle pattern. A break out of the rectangle will provide a near-term direction. Monday’s close below Friday’s midpoint indicates the pattern will likely break lower. Upon a close below 243.5 look for the pattern to break lower and decline to at least 236.4, which then connects to 225.1 and 213.2. A close over 253.8 would call for a break higher, and would open the way for 259.7, 267.4, and 282.1.

For more information and to take a trial of Kase’s weekly energy forecasts please visit the Energy Price Forecasts page.

Published by

Dean Rogers, CMT

Dean Rogers, CMT is the general manager of the Kase Call Center in Albuquerque, New Mexico. He oversees all of Kase and Company, Inc.’s operations including research and development, marketing, and client support. Dean began his career with Kase in early 2001 as a programmer but has developed into Kase’s senior technical analyst. He writes Kase’s award-winning weekly Crude Oil, Natural Gas, and Metals Commentaries. He is an instructor at Kase's classes and webinars and provides all of the necessary training and support for Kase's hedging models and trading indicators for both retail and institutional traders.

View all posts by Dean Rogers, CMT