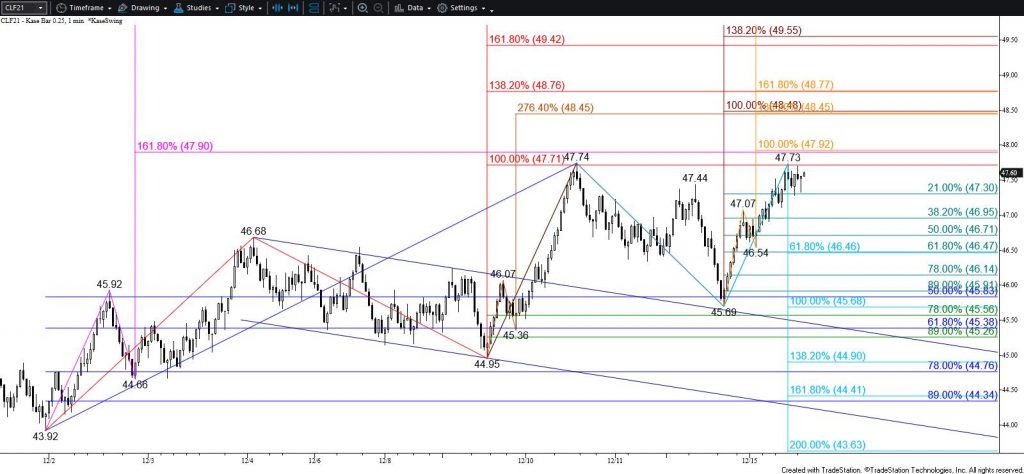

WTI Crude Oil Technical Analysis and Short-Term Forecast

The outlook for WTI crude oil remains bullish. WTI rose to challenge $47.6 as expected today. However, the move up stalled at $47.73 and might be forming a small double top with the $47.74 swing high. This is doubtful though because the waves up from $44.95 and $45.69 have overcome their smaller than targets and favor a continued rise to at least $47.9 and likely $48.7 during the next few days. The $48.7 target is the most confluent objective and a potential stalling point. Settling above $48.7 will call for the next major objective and bullish decision point at $49.5.

Nevertheless, should WTI take out initial support at $47.0 before overcoming the $47.74 swing high the odds that a double top has formed will increase. This would also call for a test of crucial near-term support at $46.5. Settling below this will shift odds in favor of challenging $45.7, which is in line with the $45.69 swing low and the confirmation point of the double top. Closing below $45.7 will confirm the double top and call for WTI to fall toward the pattern’s $43.6 target.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial