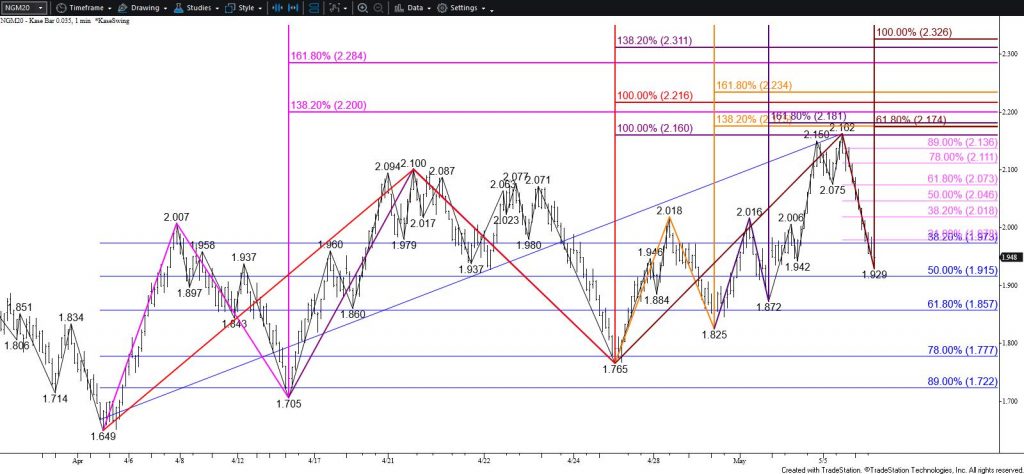

Natural gas could not overcome Tuesday’s $2.162 swing high and make the push for key resistance and the gateway for a much more bullish outlook at $2.21. Instead, prices fell and took out the 38 percent retracement of the move up from $1.649. This is bearish for the near-term but doe not mean that the move up is over. Rather, as suspected for the past few weeks, prices are still settling into a wide and volatile trading range.

Tomorrow, look for natural gas to challenge at least $1.91 and likely $1.86. The $1.86 objective is the 62 percent retracement of the move up from $1.649 and is expected to hold. Closing below this would reflect a bearish shift in sentiment and severely dampen odds for a continued rise during the next few days.

The move down from $2.162 was aggressive but lacks a meaningful wave formation. Therefore, once $1.86 is met odds for a test of resistance will increase. For now, $2.02 will likely hold and $2.07 is key. Settling above $2.07 will shift near-term odds in favor of another attempt at $2.17 and higher.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.