Natural Gas Price Forecast

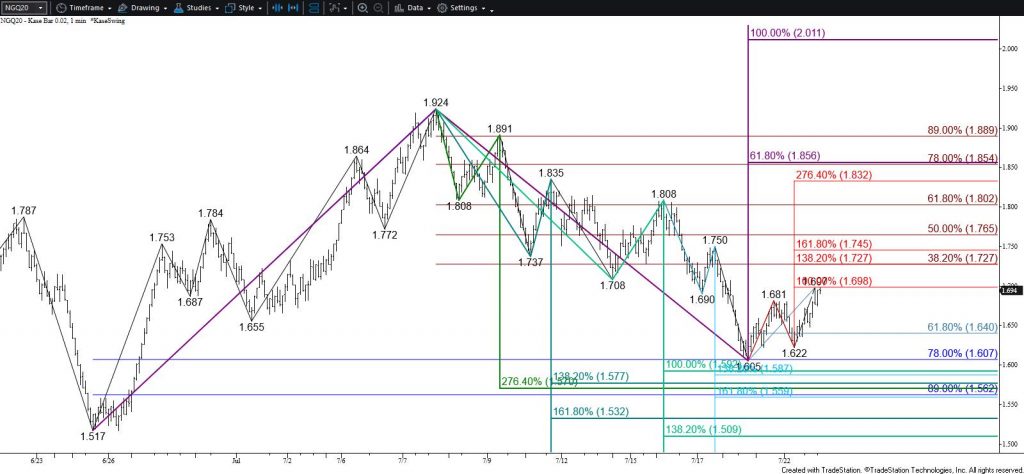

Natural gas rallied again today after falling to $1.622 in early trading hours. The subsequent move up met the $1.698 equal to (1.00) target of the wave up from $1.605. This wave is now poised to reach its $1.73 intermediate (1.382) target tomorrow. This is also the 38 percent retracement of the decline from $1.924 and is in line with the 21-day moving average. Closing above $1.73 would imply that support around $1.60 will continue to hold and that prices are settling into a wide trading range between nominally $1.60 and $1.86 for the interim.

Nevertheless, the move up may still be corrective, and until at least $1.73 is overcome there is still a reasonable chance for the move down to extend. For now, though, support at $1.64, the 62 percent retracement of the rise from $1.605, is expected to hold. Falling below this will call for another attempt at $1.59. Settling below $1.59 would confirm a break below the critical $1.60 level and shift near-term odds in favor of $1.51 and possibly lower before the August contract expires on July 29.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.