WTI Crude Oil Technical Analysis and Short-Term Forecast

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.

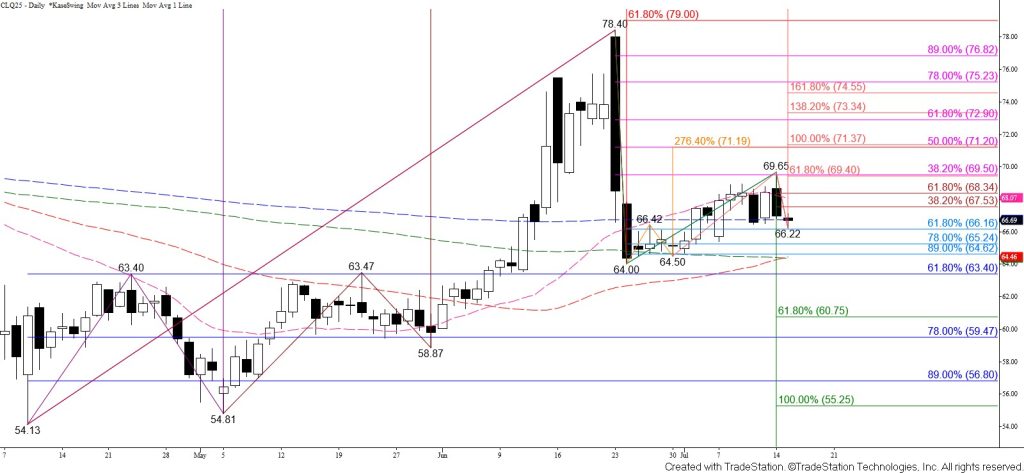

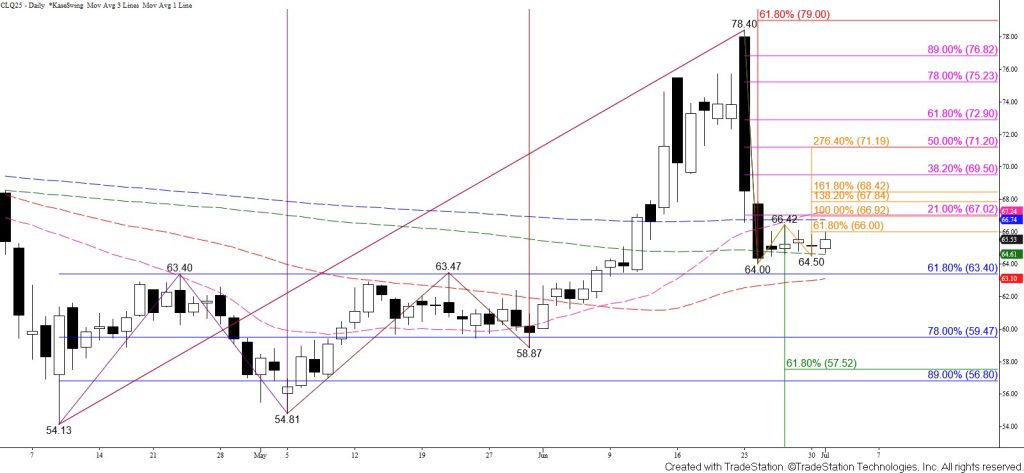

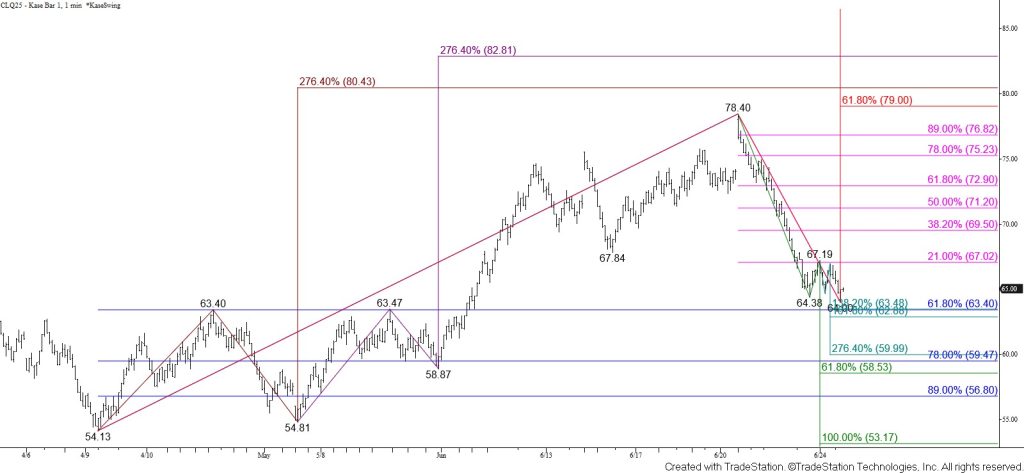

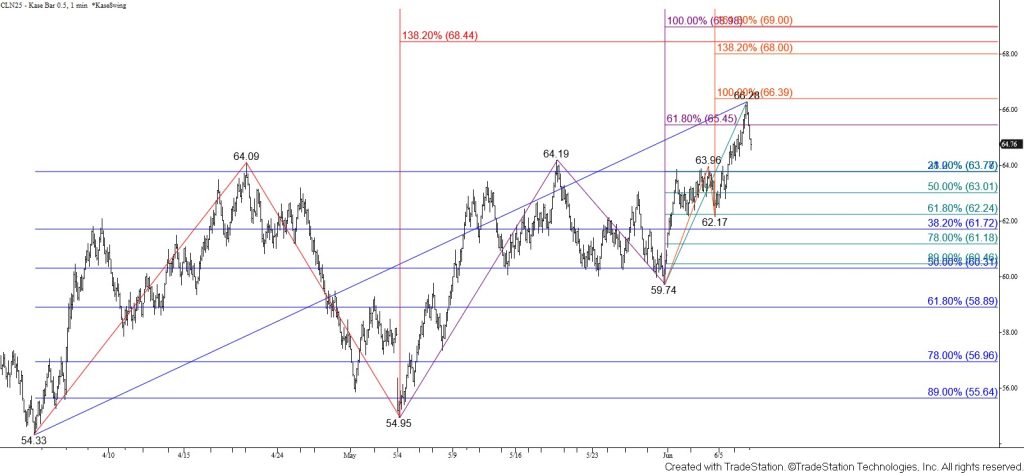

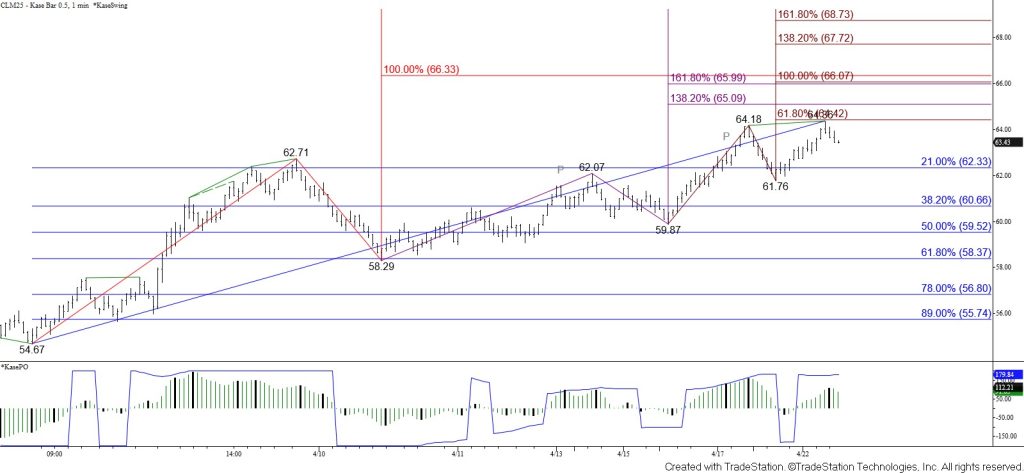

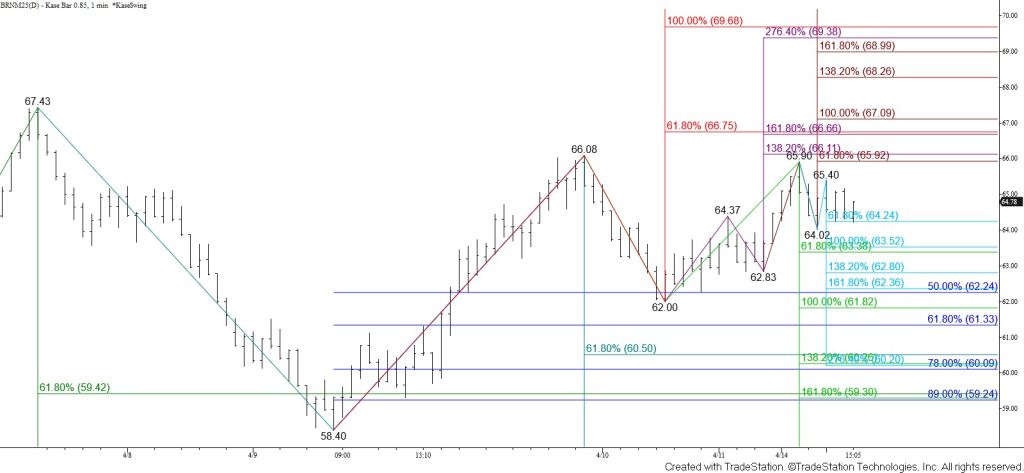

WTI crude oil confirmed Monday’s dark cloud cover and settled below the 50 percent retracement of the rise from $64.0 and the 200-day moving average. This was bearish for the near-term outlook, and a test of $66.0 is expected. Settling below this will take out the 62 percent retracement from $64.0 and warn that the recent move up is a completed correction of the decline from $78.4.

That said, the 62 percent retracement of the rise from $64.0 at $66.2 was tested and held. Moreover, today’s doji reflects uncertainty. Overcoming the 38 percent retracement of the decline from $69.65 at $67.5 will call for a test of the 62 percent retracement at $68.3. Closing above this will call for another attempt to settle above key near-term resistance and the 38 percent retracement of the decline from $78.4 at $69.5.