Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

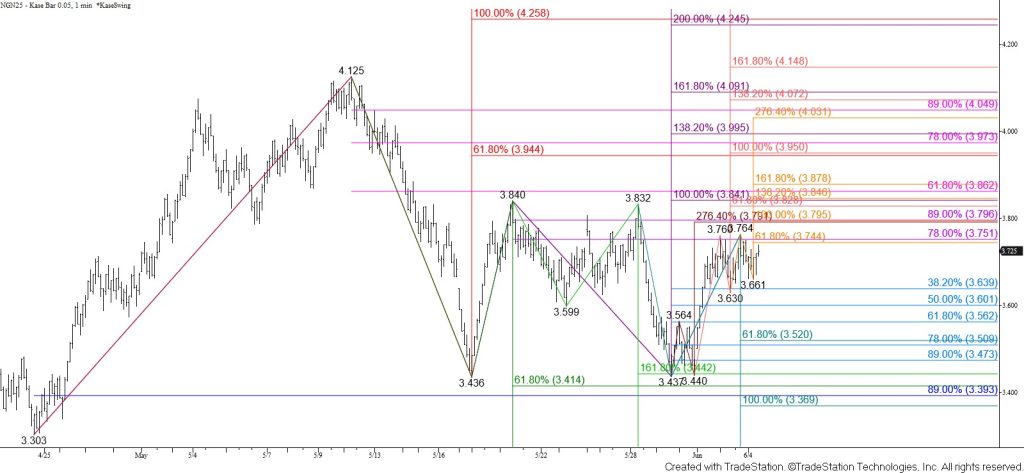

Natural gas formed a double bottom around the $3.436 swing low late last week. Prices rallied on Monday and settled above the $3.69 smaller than (0.618) target of the wave up from $3.436 and the 62 percent retracement of the decline from $3.840. The wave up from $3.436 favors a test of its $3.84 equal (1.00) target. This is the confirmation point of the double bottom and is also in line with projections of a few subwaves up from $3.437 and the 62 percent retracement of the decline from $4.125. The connection to $3.84 is made through confluent targets at $3.74 and $3.79. Settling above $3.84 will confirm the double bottom, opening the way for a test of the $3.94 smaller than target of the wave up from $3.303. This wave connects to $4.25 as the equal to (1.00) target, which is also the target of the double bottom.

That said, July natural gas is struggling to settle above the 78 percent retracement of the decline from $3.840 and the 20-day moving average. Bearish hanging man candlesticks that formed Tuesday and Wednesday also warn that a test of support might occur first and that the move up may fail to reach $3.84 within the next few days. Taking out $3.65 would call for a test of $3.56 and possibly key near-term support at $3.51. Settling below $3.51, which is near the smaller than target of the wave down from $3.832, will shift the odds in favor of prices falling to negate the double bottom and challenge the $3.41 smaller than target of the wave down from $4.125 instead.