Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

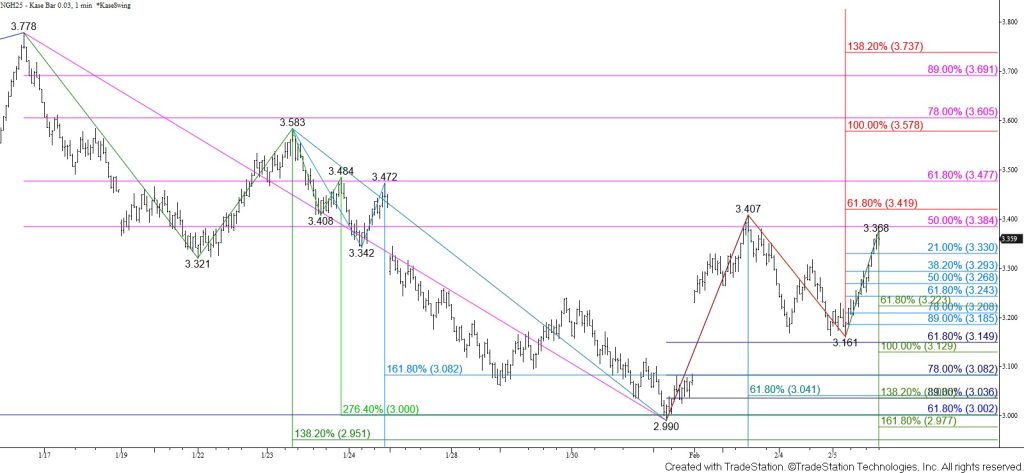

Natural gas tested and held support at $3.16 before rising to challenge the 50 percent retracement of the decline from $3.778 at $3.38 again. Today’s rise was bullish for the outlook during the next few days. March natural gas is now poised to overcome $3.38 to challenge the $3.42 smaller than (0.618) target of the wave up from $2.990. Settling above this will call for a push above the 62 percent retracement of the decline from $3.778 at $3.48 to fulfill the $3.59 equal to (1.00) target of this wave.

The $3.38 target held on Monday and the move up from $3.161 is due for a correction soon. Should prices pull back look for the 38 percent retracement of the rise from $3.161 at $3.29 to hold. Falling below this will call for a test of key near-term support at $3.23. This threshold is split between the 62 percent retracement and smaller than target of the wave down from $3.407.