Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

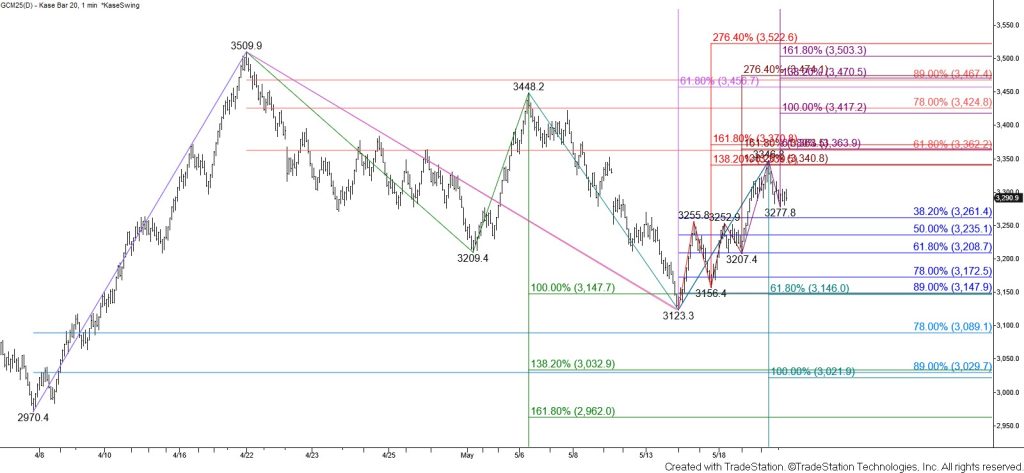

Gold rose to fulfill the $3341 intermediate (1.382) target of the waves up from $3123.3 and $3156.4 before pulling back. Today’s bearish engulfing line warns that a test of at least the 38 percent retracement of the rise from $3123.3 at $3261 will occur first. However, while the 62 percent retracement at $3209 holds, the near-term outlook should continue to lean bullish.

Settling above $3341 will call for a test of a key target at $3368 that is in line with projections of the waves up from $3123.3, $3156.4, and $3207.4, as well as the 62 percent retracement of the decline from $3509.9. Settling above $3368 will strongly suggest that the corrective pullback from $3509.9 is complete and that prices will rise to $3420 and higher in the coming days.