Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

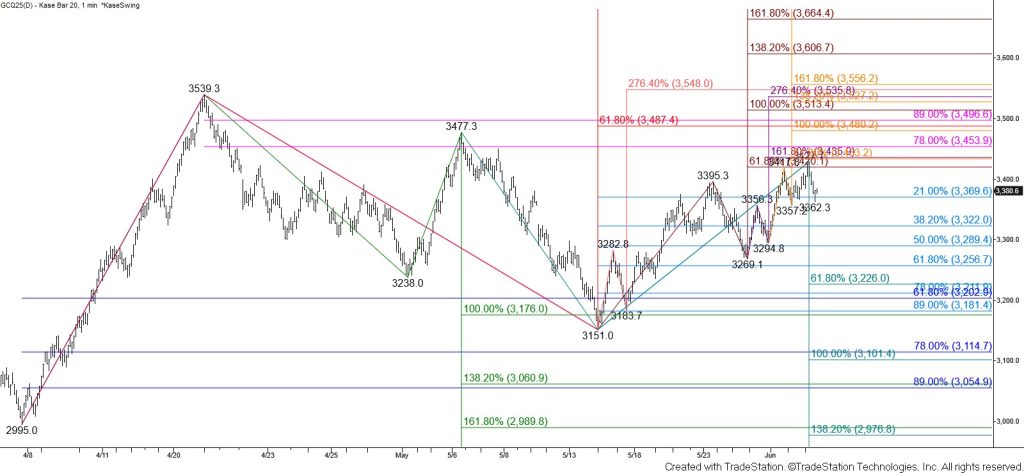

Gold tested and held the $3420 smaller than (0.618) target of the primary wave up from $3151 today. Most waves that meet the smaller than target extend to eventually fulfill at least the equal to (1.00) target, in this case, $3500. Therefore, the outlook for gold remains bullish. Settling above $3425, a confluence point among the projections of the waves and subwaves up from $3151, will open the way for $3454 and then $3500.

Nevertheless, the pullback from $3427.7 may test $3322 first. This is the 38 percent retracement of the rise from $3151 and a level that a normal correction should hold. Closing below $3322 would call for an extended correction to challenge the respective 50 and 62 percent retracement at $3290 and $3257. Gold must settle below $3257 to imply that the move up from $3151 is complete and that a reversal is underway.