Gold Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

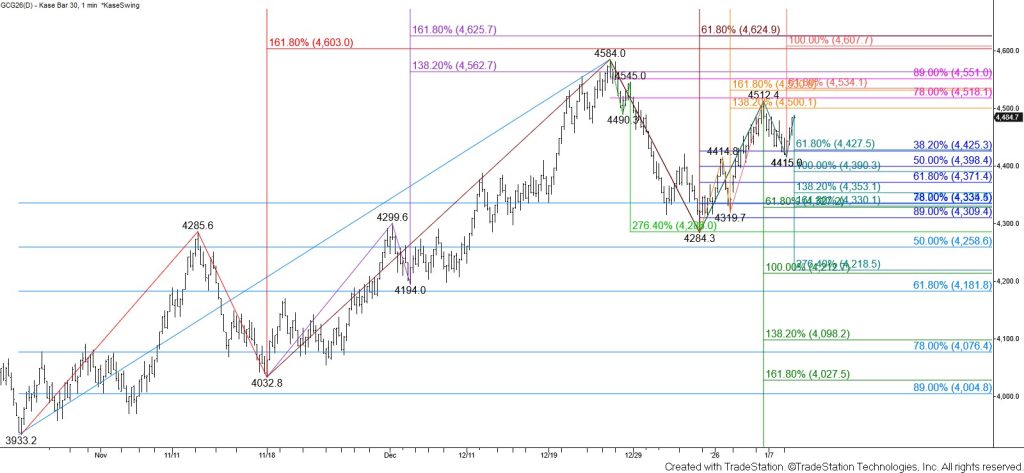

February gold’s pullback from $4584 looks like it is a completed correction. The $4286 XC (2.764) projection of the first wave down from $4584 and the 38 percent retracement of the rise from $3933.2 held on a closing basis. The subsequent rise fulfilled the $4500 intermediate (1.382) target of the wave up from $4284.3 and settled above the 62 percent retracement of the decline from $4584. Most recently, the 38 percent retracement of the rise from $4284.3 held and prices rose above the $4478.4 corrective swing high, invalidating the prior primary wave down from $4512.4.

Gold is poised to test $4500 again. Settling above this will call for the $4532 larger than (1.618) target of the wave up from $4284.3 and the smaller than (0.618) target of the wave up from $4319.7. Closing above $4532 will clear the way for another test of the $4563 intermediate target of the first wave up from $4302.8 and likely a new high of $4615.

Based upon the current wave structure, key support for the near-term is the $4327 smaller than (0.618) target of the wave down from $4584. Should prices fall again and take out the $4426 smaller than target of the new wave down from $4512.4, look for a test of $4394, $4362, and possibly $4327. Closing below $4327 will shift the near-term odds in favor of gold falling to $4259 and eventually the $4212 equal to target of the wave down from $4584.