Natural Gas Technical Analysis and Near-Term Outlook

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.

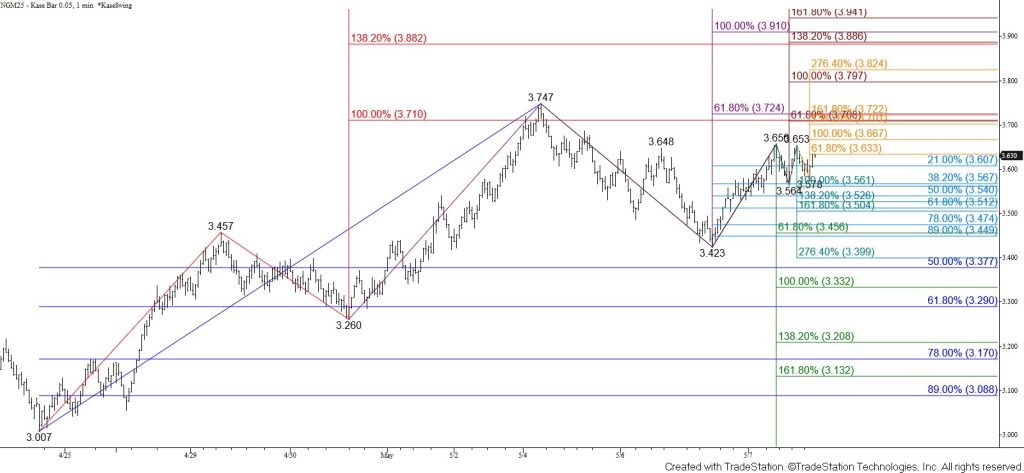

Natural gas overcame the $3.648 corrective swing high of the prior primary wave down from $3.747 that had called for a test of $3.38. Prices settled just below the 62 percent retracement of the decline from $3.747, but the small wave up from $3.564 calls for a test of its $3.67 equal to (1.00) target. Overcoming $3.67 will clear the way for another attempt to settle above a highly confluent and key $3.72 objective. Closing above $3.72 will open the way for $3.81 and likely $3.90 in the coming days.

After rising to $3.656, prices settled into a small range that forms a coil. This pattern should break higher, but coils are not reliable continuation patterns. Taking out $3.56 will confirm a break lower out of the coil and call for a test of $3.50. The $3.50 level is expected to hold. Falling below this would call for a test of key near-term support and the smaller than (0.618) target of the new primary wave down from $3.747 at $3.46.