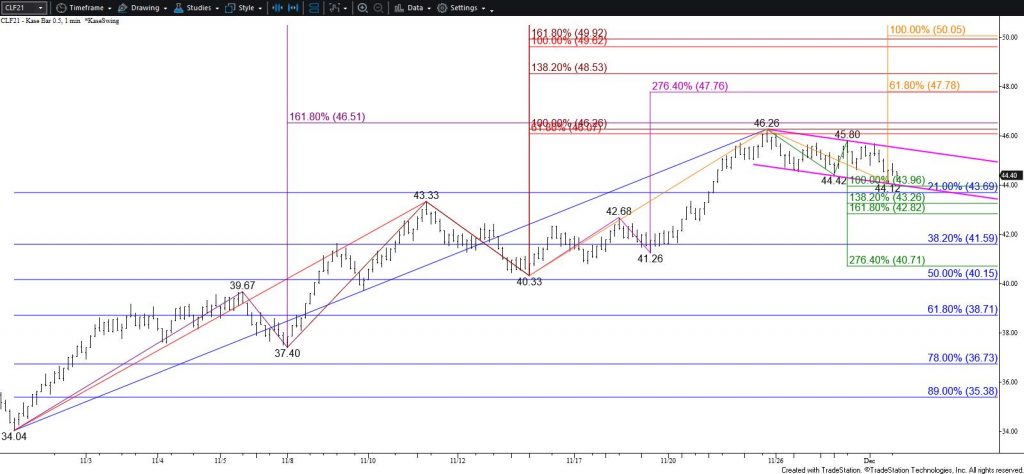

WTI Crude Oil Technical Analysis and Short-Term Forecast

WTI crude oil took out $44.6 and fell to challenge support around $43.9. This lower objective, which is adjusted to $43.8 for tomorrow, is a highly confluent and crucial wave projection and retracement. Another attempted test of $43.8 is expected. However, settling below $43.8 might prove to be a challenge because the decline from $46.26 is most likely corrective and forms a bullish flag that should break higher during the next few days.

Nevertheless, taking out $43.8 will negate the flag and clear the way for $43.3 and possibly $42.8. These are the intermediate (1.382) and larger than (1.618) targets of the primary wave down from $46.26.

That said, the long-term outlook for WTI is bullish, and as stated, the decline from $46.26 will most likely prove to be a correction of the move up from $34.04. Furthermore, should WTI overcome $44.9 before taking out $43.8 look for a test of key near-term resistance at the $45.8 intra-day swing high. Overcoming $45.8 will invalidate the wave down from $46.26 that calls for $43.8 and lower and will confirm a break higher out of the bullish flag. This will clear the way for a test of crucial resistance at $46.4.

Brent Crude Oil Technical Analysis and Short-Term Forecast

Brent crude oil fell to challenge support at $46.8 as called for. The decline from $49.0 is most likely corrective and forms a bullish flag that should break higher in the coming days. However, the primary wave down from $49.0 now calls for a test of $46.4 first. Closing below this tomorrow will negate the flag and clear the way for $45.7 and possibly $45.2 instead.

For now, Brent is expected to hold $47.7 as the move down extends toward $46.4. Overcoming $47.7 will call for key near-term resistance at $48.3. Rising above this will invalidate the wave down from $49.0 that calls for $46.4 and lower and will confirm a break higher out of the bullish flag.

This is a brief analysis for the next day or so. Our weekly Crude Oil Forecast and daily updates are much more detailed and thorough energy price forecasts that cover WTI, Brent, RBOB Gasoline, Diesel, and spreads. If you are interested in learning more, please sign up for a complimentary four-week trial.