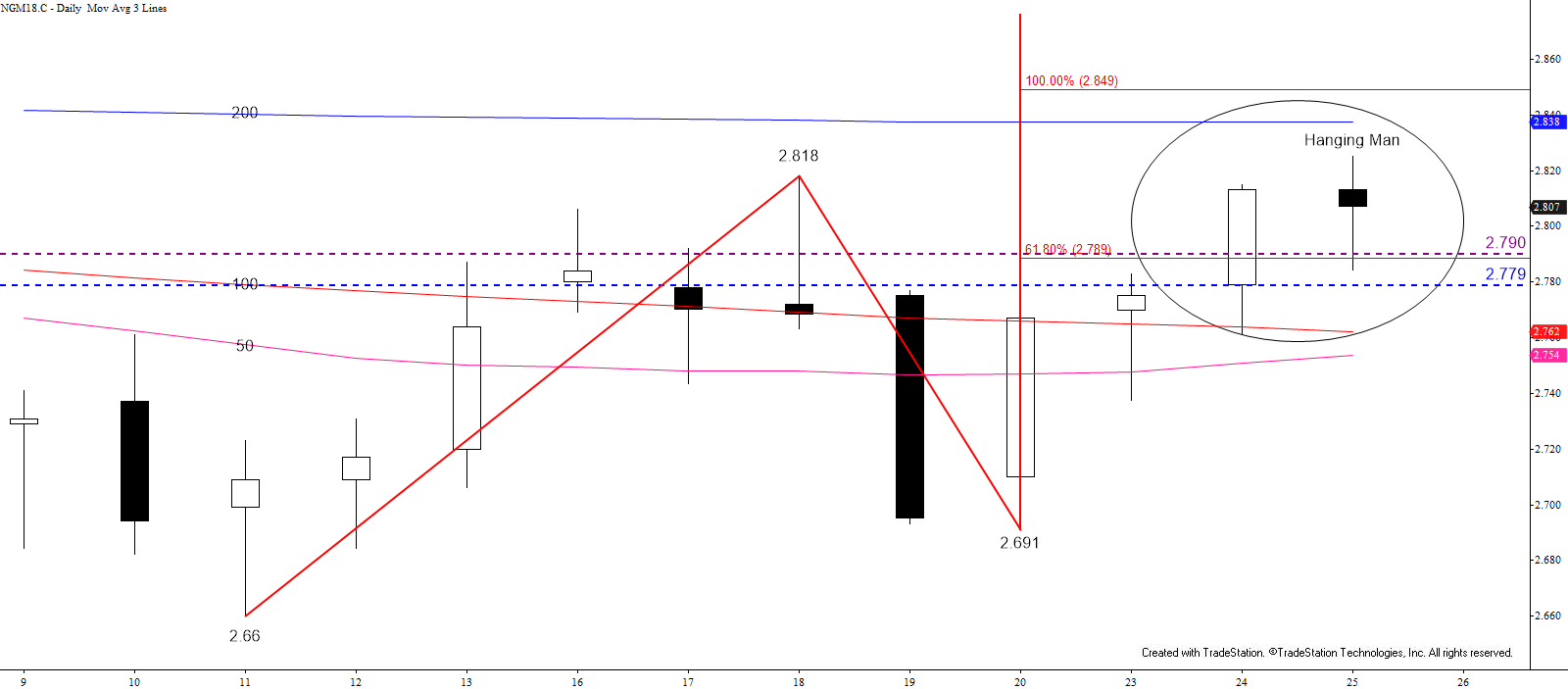

June natural gas remains range bound between nominally $2.65 and $2.87 but has been working its way toward the upper end of the range for the past few days. A test of $2.84 is expected early tomorrow but this level will probably hold as there is evidence the move up is exhausted and poised for another test of $2.78 and possibly lower.

June sustained a close over $2.79, the smaller than (0.618) target of the wave up from $2.66, for the past two days. The equal to target for this wave is $2.85, which is near $2.84, the 200-day moving average. Waves that meet the smaller than target generally extend to the equal to target. Therefore, there is a good chance for at least $2.84 early tomorrow. This is extremely strong and important resistance, so a close above $2.84 would be quite positive for the near-term. However, to prove June has broken out of the recent range a close above the $2.873 swing high is necessary. For now, such a move is not expected without help from external factors (i.e. another larger than expected withdrawal from storage).

That said, today’s early move up fulfilled the $2.825 equal to (1.00) target of the wave up from $2.691 and the subsequent pullback formed a daily hanging man reversal pattern. The hanging man and confirmed bearish intra-day divergences indicate the move up is exhausted and ready for another test of $2.78. This is the hanging man’s confirmation point, a close below which would open the way for another downward oscillation within the trading range to $2.75 and lower.

So, with all factors considered look for a move up to at least $2.84 and then for a test of $2.78 again within the next day or so. Settling beyond either of these levels should paint a clearer picture of next week’s outlook.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.