Natural Gas Near-Term Oulook

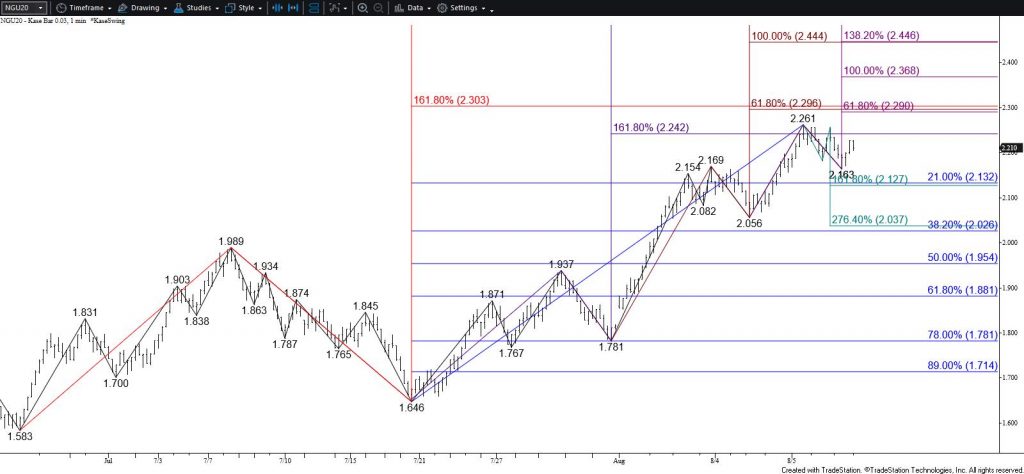

The outlook for natural gas has taken on a much more bullish tone after breaking higher out of the months-long trading range between nominally $1.60 and $1.93 on Monday. The move up stalled at $2.261 today but is still poised to challenge $2.30. This is the most confluent wave projection and a crucial objective for September’s primary wave up from $1.583 and the continuation charts primary wave up from $1.432. Settling above $2.30 may initially be a challenge but will clear the way for $2.37 and likely $2.44.

Nevertheless, the pullback after reaching $2.261 formed a long upper shadow on the daily candlestick. The body of today’s candlestick is too big to form a shooting star, but the long upper shadow suggests the move up may be nearing exhaustion. Several daily momentum oscillators are also sitting just below overbought territory. Therefore, a significant test of support may take place soon; most likely once the $2.30 objective is fulfilled.

The move down from $2.261 this afternoon has been choppy and is most likely corrective. Even so, there is a reasonable chance for this correction to challenge $2.13 early tomorrow. Support at $2.13 is expected to hold. A move below this will call for key near-term support at $2.03. This is the lowest the first wave down from $2.261 projection and is the 38 percent retracement of the rise from $1.646. Settling below $2.03 is doubtful but would significantly dampen odds for a continued rise to $2.30 and higher during the next few days.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.