This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ration, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.

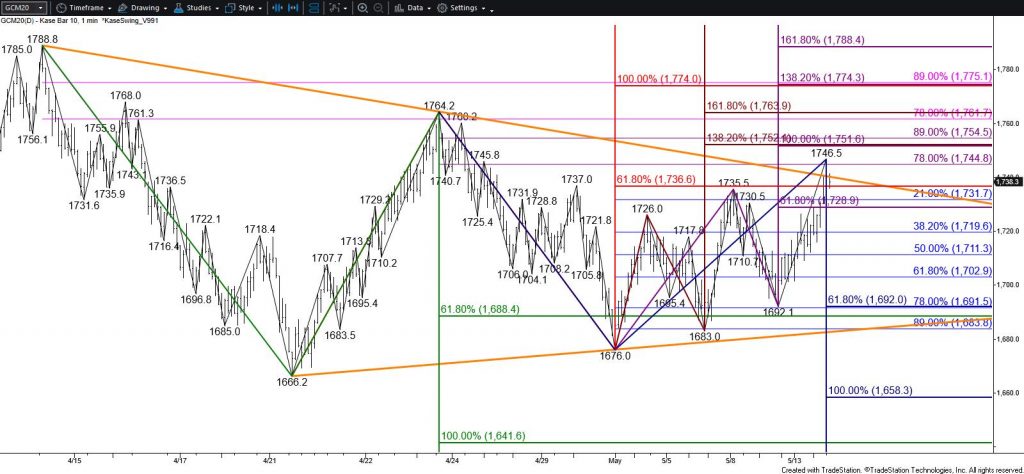

Gold broke higher out of a coil pattern and settled the day above $1737, the smaller than (0.618) target of the wave up from $1666.2. The move up is now poised to reach at least $1752 and likely $1774 during the next few days. Settling above $1774 will clear the way a new high of $1802 and then the next major objective of $1821.

Prices are still flirting with the coil’s upper trend line, so there is a modest chance for another test of support once $1752 is met. Support at $1720 will likely hold, but a decline to $1702 and even $1690 would still be considered corrective of the move up from $1676.0. Settling below $1690 is unlikely but would shift near-term odds in favor of $1658 and possibly lower.