Gold Technical Analysis and Near-Term Outlook

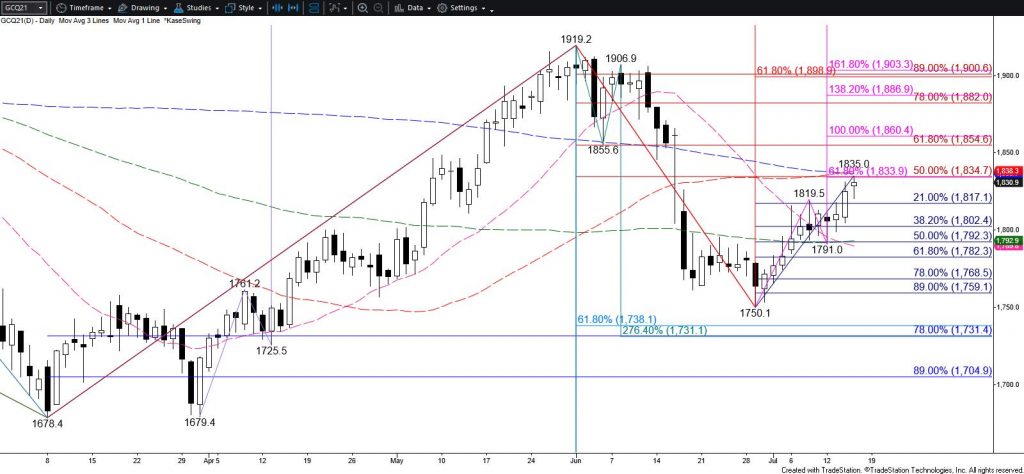

Gold challenged $1835 as expected and stalled. This is a bullish decision point for gold because it is in line with the 50- and 200-day moving averages, the 50 percent retracement of the decline from $1919.2, and the smaller than (0.618) target of the primary wave up from $1750.1. Most waves that meet the smaller than target extend to fulfill the equal to (1.00) target, in this case, $1857. Therefore, the outlook for gold is bullish and odds favor a move and close above $1835 soon.

However, the formation of a daily long-legged doji suggests that a test of support will probably take place first. Closing below $1817 will complete the doji and settling below $1802 will confirm the reversal pattern. A move below $1802 is doubtful but would shift near-term odds in favor of a deeper test of support before the move up continues.

This is a brief analysis for the next day or so. Our weekly Metals Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key COMEX precious metals futures contracts and LME Non-Ferrous (Base) metals, spot gold, the gold/silver ratio, and gold ETFs. If you are interested in learning more, please sign up for a complimentary four-week trial.