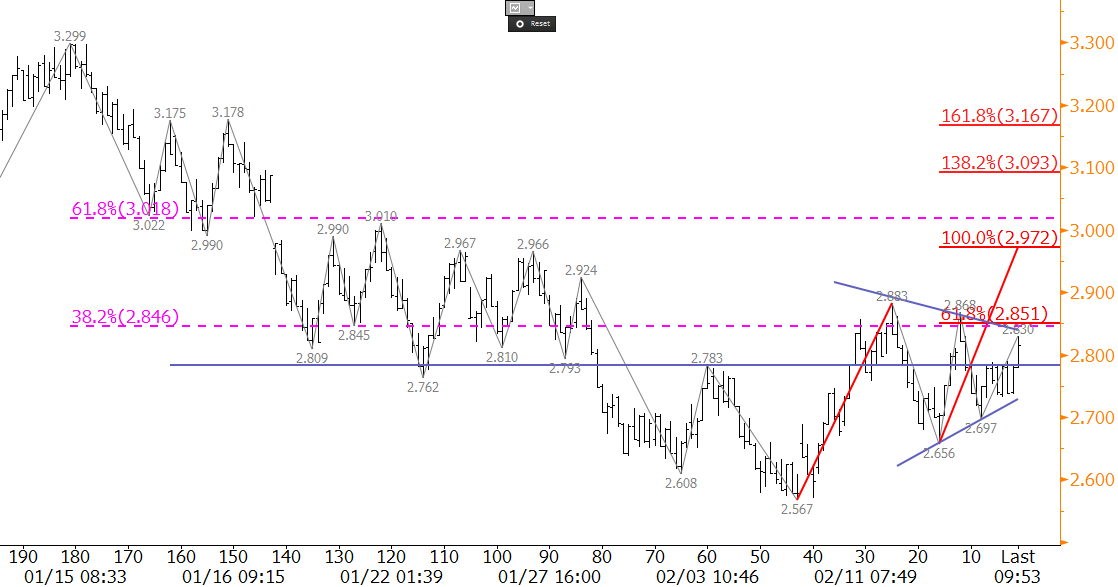

Natural gas’s upward correction has stalled and is oscillating in a narrowing range centered around $2.78. This is a coil formation, which indicates that a breakout move is about to take place. The coil shows undertones of the market’s uncertainty between the balance of long-term bearish fundamentals and recent wide sweeping cold weather that has dominated headlines for the past few days. Typically, prices will break in the direction that the market entered the pattern, in this case up. However, coils are not statistically reliable continuation patterns like flags, pennants, or triangles. Therefore, caution is warranted for both bulls and bears headed into tomorrow’s U.S. Energy Information Administration (EIA) Natural Gas Weekly Update.

A break higher out of the coil and an extended correction would be confirmed by a close over the confluent $2.85 level. The confluence is the crucial factor behind this level because $2.85 is the 0.618 projection for the wave $2.567 – 2.883 – 2.656 and the 38 percent retracement from $3.299 to $2.567. A close over $2.85 would call for $3.00, which is also confluent because it is the 1.00 projection and the 62 percent retracement.

A break lower would be triggered upon a close below $2.73. This is the 0.618 projection for the wave $2.883 – 2.656 – 2.868, and in turn connects to $2.64 and then $2.55 as the 1.00 and 1.382 projections. Both targets are in line with major swing lows at $2.656 and $2.567, so a break lower out of the coil would have major bearish ramifications for the near term.

Take a free-trial of Kase’s weekly energy price forecasts.