by Dean Rogers

by Dean Rogers

Read on TraderPlanet.com

You can feel it in the air, the mounting anticipation of an interest rate hike is coming to a head as investors, traders, and even my own feisty grandmother are jockeying for position ahead of this week’s Fed meeting.

Some pundits believe a rate hike at this time would be disastrous and that Tuesday’s S&P 500 gain of 1.3 percent was a sign the markets are telling the Fed to wait. Others believe the rate hike is long overdue and that the sooner the Fed raises rates the better.

There is a lot of indecision about what the Fed will do this week. However, one thing is for certain, whether Feds hike rates or not, the market’s direction for at least the next few weeks, and possibly months, will be determined within the next 48 hours.

What Do The Technical Factors Say?

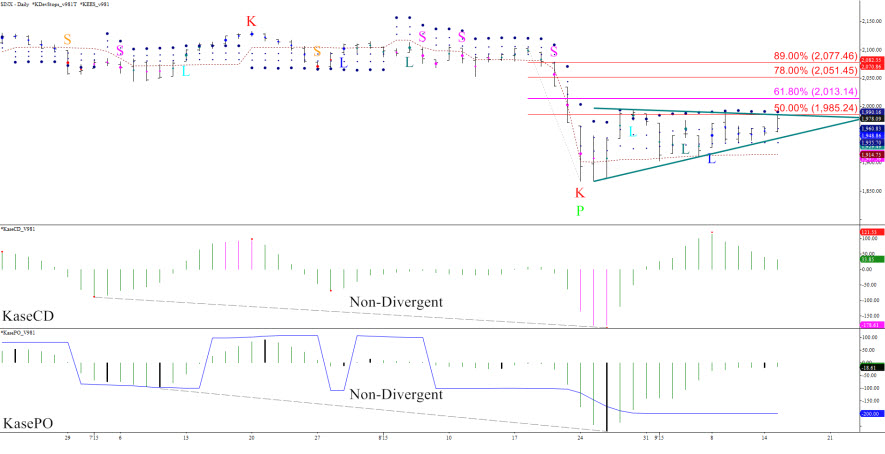

The formation of a pennant reflects the market’s indecision. The pattern is bearish because it formed after the decline to 1867.01 on August 24. That said, there are enough bullish factors to indicate this formation has a higher than normal probability to fail.

Charts created using TradeStation. ©TradeStation Technologies, Inc. 2001-2015. All rights reserved. No investment or trading advice, recommendation or opinions are being given or intended.

Charts created using TradeStation. ©TradeStation Technologies, Inc. 2001-2015. All rights reserved. No investment or trading advice, recommendation or opinions are being given or intended.

Bearish Technical Factors

- Pennant

- Move up from 1867.01 stalled near the 50 percent retracement of the decline from 2103.47

- Held Kase’s daily DevStop3 (large blue dot)

- Decline to 1867.01 was non-divergent

The bottom of the pennant is near 1950 and a close below this would open the way for 1903. This then connects to confluent wave projections at 1838, 1732, 1665, and 1567. Upon a break lower out of the pennant we expect to see at least 1838 and very possibly 1732.

The lowest target at 1567 is interesting because it is near the 38 percent retracement from the March 2009 swing low of 666.79 to the recent 2134.72 swing high. In addition, 1567 is near the October 2007 high of 1576.09, just before the financial crisis, and the March 2000 high of 1552.87, just before the dotcom crash.

I am not calling for 1567 yet, but from a longer-term perspective, a decline to 1567 would be a normal technical correction (38 percent), and a 25 percent correction from high to low (less than half of the financial crisis’s decline).

Bullish Technical Factors

- KCDpeak and PeakOut (oversold signals)

- KEES buy signals (blue L’s) and long permissions (blue dots)

A close over 1985 would confirm the bearish pennant has failed and open the way for at least 2022, the 1.00 projection for the wave 1867.01 – 1993.48 – 1903.07. Then connects to confluent projections at 2070 and 2109 as the 1.382 and 1.618 projections, respectively. The latter is the last level protecting the 2134.72 high.

Conclusions

It is a very tough call and the market could break either way. On balance though, I see enough bearish evidence to state that I think the Fed will hike rates and the markets will break lower.

Now if you’ll excuse me, I need to call to my grandmother and tell her not to bet the farm on the downside. Maybe some puts are in order.

“Ask Kase” and your question may be chosen as the subject of a future column (askkase@kaseco.com).

Send questions for next week to askkase@kaseco.com, and click the link learn more about the KasePO, KaseCD, KEES, and the Kase DevStops.