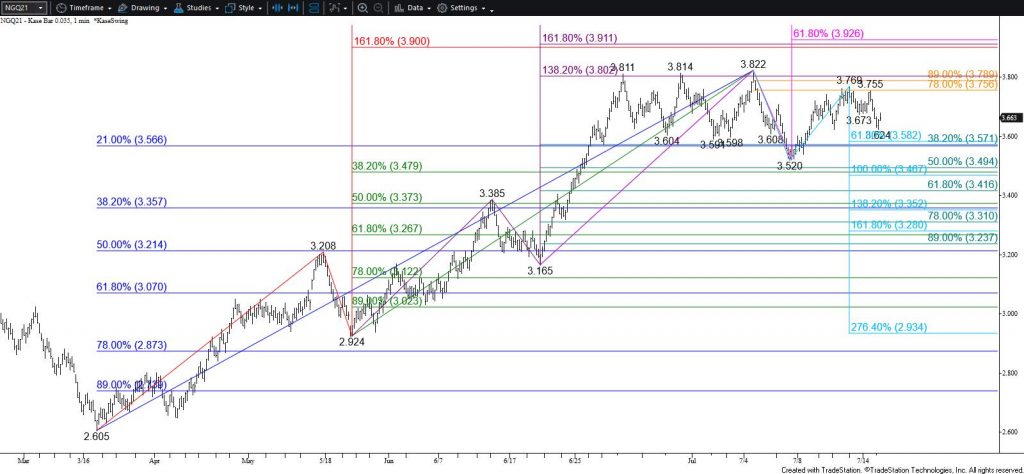

Natural Gas Technical Analysis and Near-Term Outlook

Natural gas continues to trade in an erratic range bound between approximately $3.60 and $3.81. Monday’s rise to $3.769 looks as though it was a shortfall (a failure to test the range’s upper trend line) within the range. The waves down from $3.822 and $3.769 are poised to test $3.59. This is the smaller than (0.618) target of the primary wave down from $3.822. Closing below $3.59 would confirm a break lower out of the range and clear the way for $3.54 and likely $3.48 in the coming days.

Nevertheless, prices have risen this afternoon and a test of $3.71 might take place first. This level is expected to hold. Overcoming $3.71 will call for $3.77 and possibly $3.82. Settling above $3.82 would confirm a break higher and shift odds in favor of challenging another highly confluent and major threshold at $3.91.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.