After a good up month in April for the British Pound, some pundits are calling for weakness, and attributing this to the probability that post the UK’s May 7 election, formation of a coalition government is likely.

This virtual eventuality has been in the news for at least a couple of months. If it were so bearish, one would think it would have become a factor much sooner than six days before the election.

Despite the prospect of a coalition government, a coalition led by Cameron versus Miliband is not the same thing. The Economist endorsed Cameron notwithstanding some drawbacks, such as a possible alliance with anti-EU UKIP. It looks like his leadership, even so, would be better for the UK economically than one led by Miliband, whose cumulative redistributionist ideas could scare away high earners and entrepreneurs.

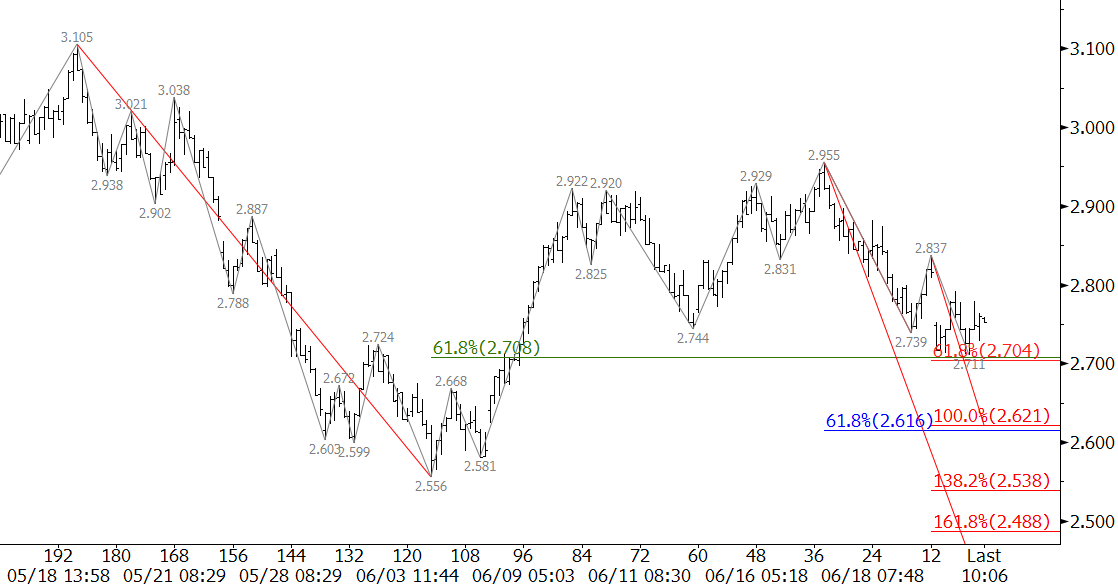

It’s been said that explanations are always after the fact. Let’s see what the British Pound/US Dollar is saying for itself.

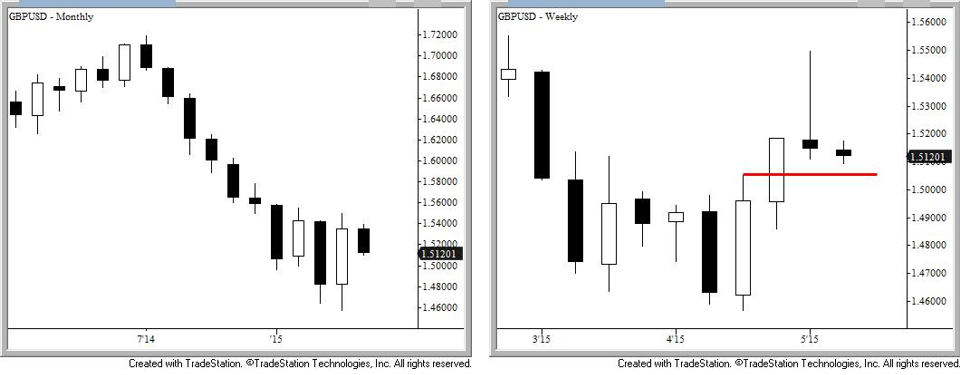

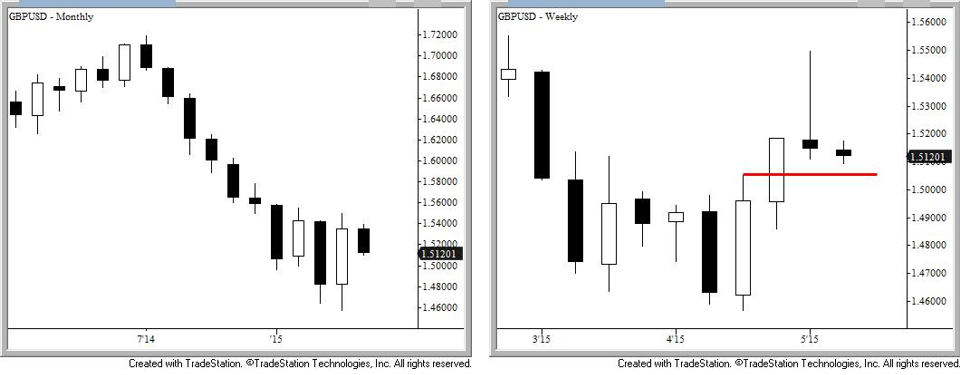

The rise in value of the pound from April 13 to 29 has the characteristic of being driven by over exuberance. There are many opens that jumped higher than the previous day’s close, or if not, opened only a hair below. This looks like typical short-term emotionality.

The high of this move, 1.54969 failed to overcome that of more than two months earlier, 1.5512, so it’s not as if we’re talking about a major bull market here. Indeed all the bullish excitement has been about one up month, April. This overhyped month, though it had a reasonably large open-close range, failed to close over March’s open.

Technically charts show what’s called a piercing pattern, versus, an engulfing line. So though April “pierced” March’s armor, March was not engulfed. Clearly then this dampens April’s importance.

April was number 10 in a 10 month decline, and only the second to be an up month (the other was February). April made lows not seen since July 2010. The price low triggered a very mild oversold signal, but it’s not unusual for this to happen and be followed by a bit of a bounce.

Negating the importance of this is that overbought April, at least so far, has not been confirmed by and up closing May (again so far). The fact that May’s been down decreases the significance of the oversold signal, and even more so emphasizes a lack of disparity between negative momentum and negative trend.

The weekly is setting up a bearish pattern called a Harami star. A close below about 1.50, which is last week’s open-close midpoint, and the high for the week prior, would call for expectations to clearly look lower.

Indeed last week’s high was well above both its open and close. This means that prices tried very hard to climb up, fell right back down, in this case, to just below the where prices started the week.

Monthly and Weekly Candlesticks

All markets have corrections, and often it’s expected that these will be of particular magnitudes. Here, another bearish factor is that the price decline smashed through the 38 percent retracement, and would now be expected to decline at least to about 1.503ish to meet next major retracement of 50 percent.

Bottom line is that the British Pound can’t tell us who will be the next Prime Minister, or whether a coalition must be formed, but it is telling us that it’s not feeling very well right now.

There have only been a few down days so far this month, and the down move may prove only corrective, but if we see a close below $1.50ish, then a retest of April’s low might become increasingly likely.

Charts created using TradeStation. ©TradeStation Technologies, Inc. 2001-2014. All rights reserved. No investment or trading advice, recommendation or opinions are being given or intended.