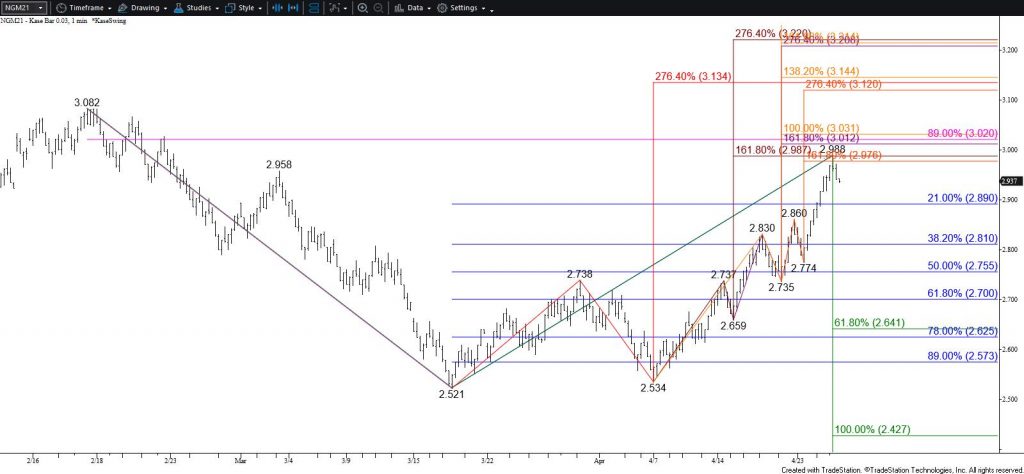

Natural Gas Technical Analysis and Near-Term Outlook

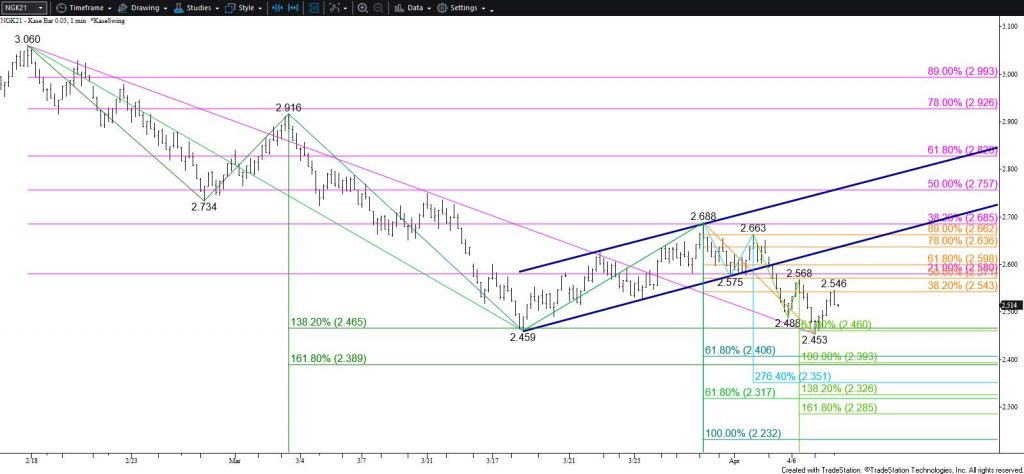

The outlook for natural gas remains bullish because the move up from $2.521 looks to be forming a five-wave pattern that targets at least $3.03 and possibly $3.13. However, the move up is showing signs of exhaustion as it tries to overcome $3.00. This includes the potential formation of an ending diagonal pattern for Wave V. Even so, a move above $2.99 will call for $3.03 to be challenged. This is a highly confluent wave projection and retracement. Therefore, natural gas will likely be hard-pressed to settle above $3.03 without another test of support first. An eventual close above $3.03 would call for $3.08 and likely $3.13.

That said, momentum oscillators are waning and the bearish daily candlestick patterns, including a bearish engulfing line today, suggest a test of $2.90 and possibly $2.86 might take place first. Support at $2.86 is expected to hold. However, taking out $2.86 will call key support at $2.83 to be challenged. Settling below $2.83 remains doubtful but would reflect a bearish shift in supply and demand and near-term sentiment.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.