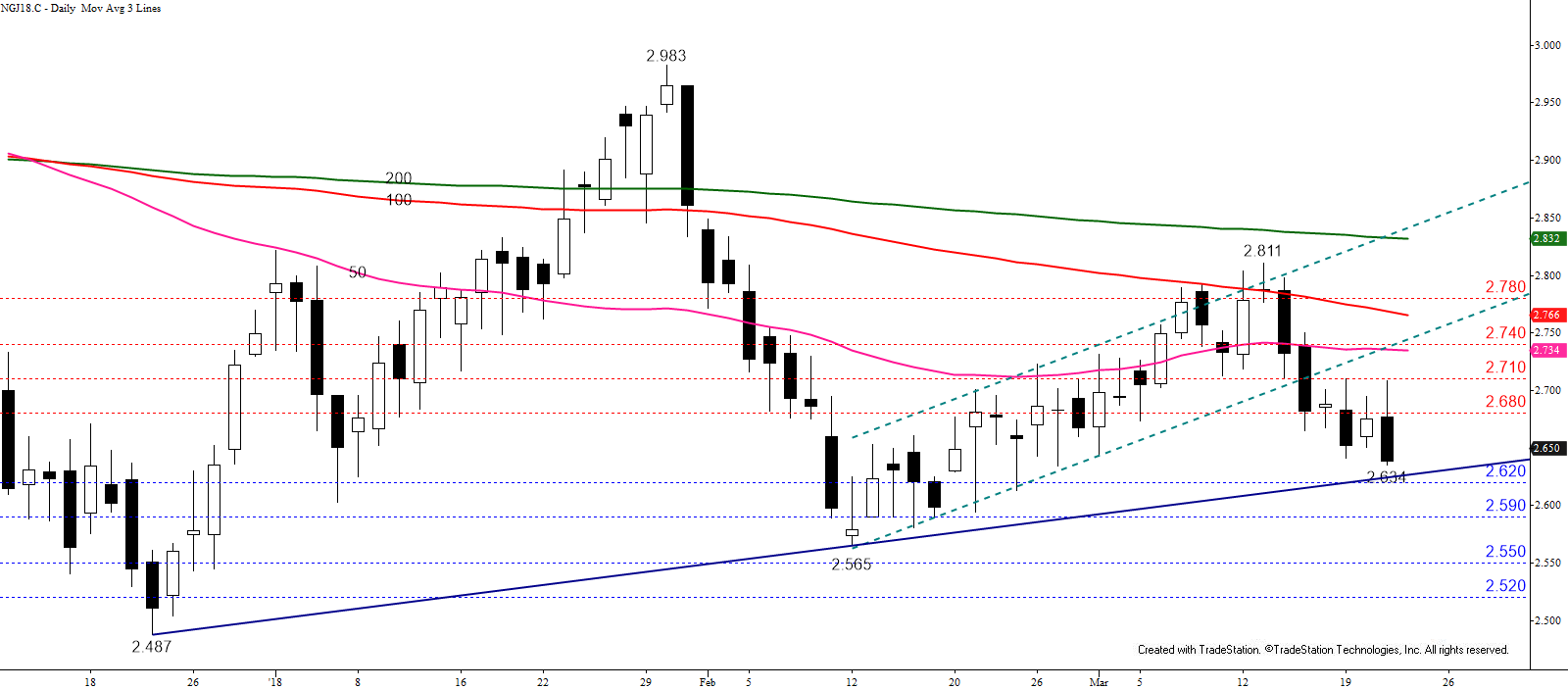

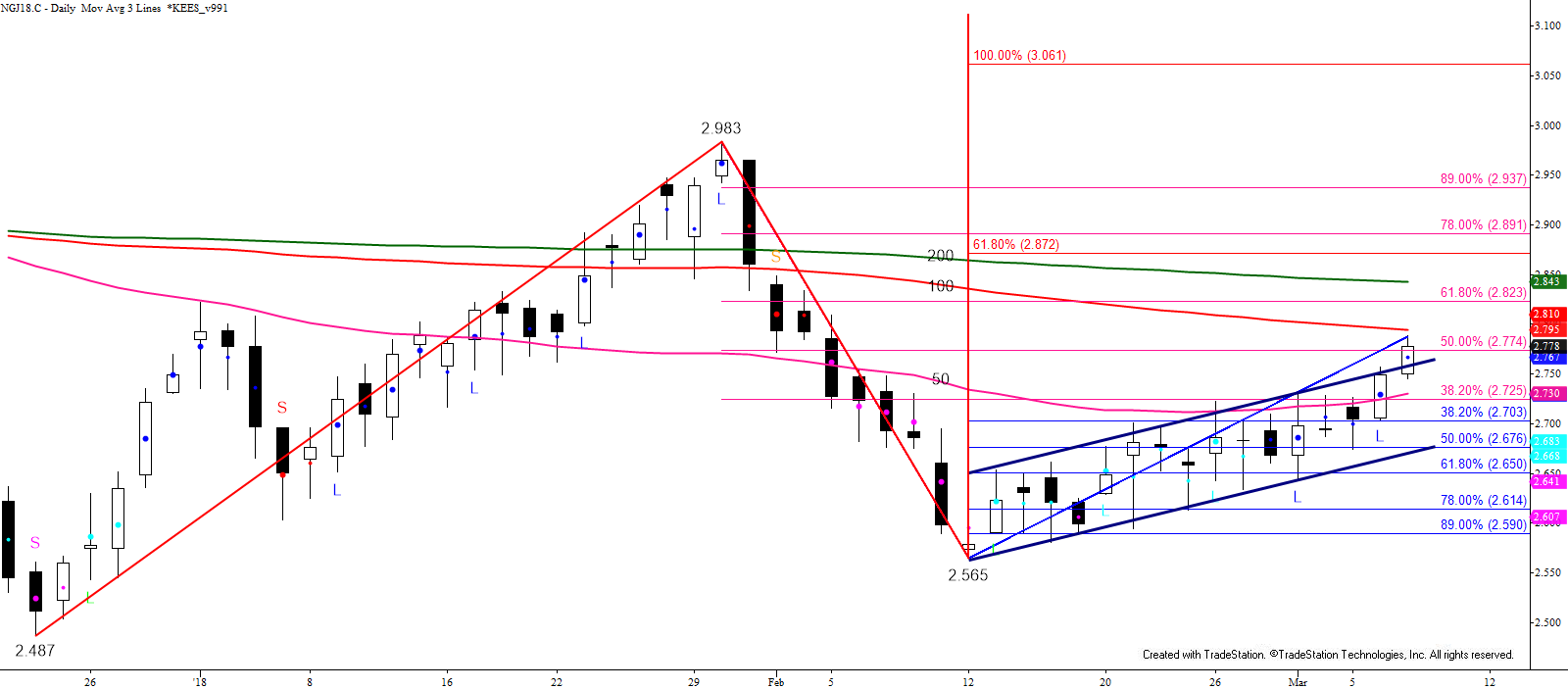

Natural gas is still oscillating within a range between nominally $2.60 and $2.80. Traders are likely waiting on external factors to push the market out of the range, so for now, erratic trading will most likely continue.

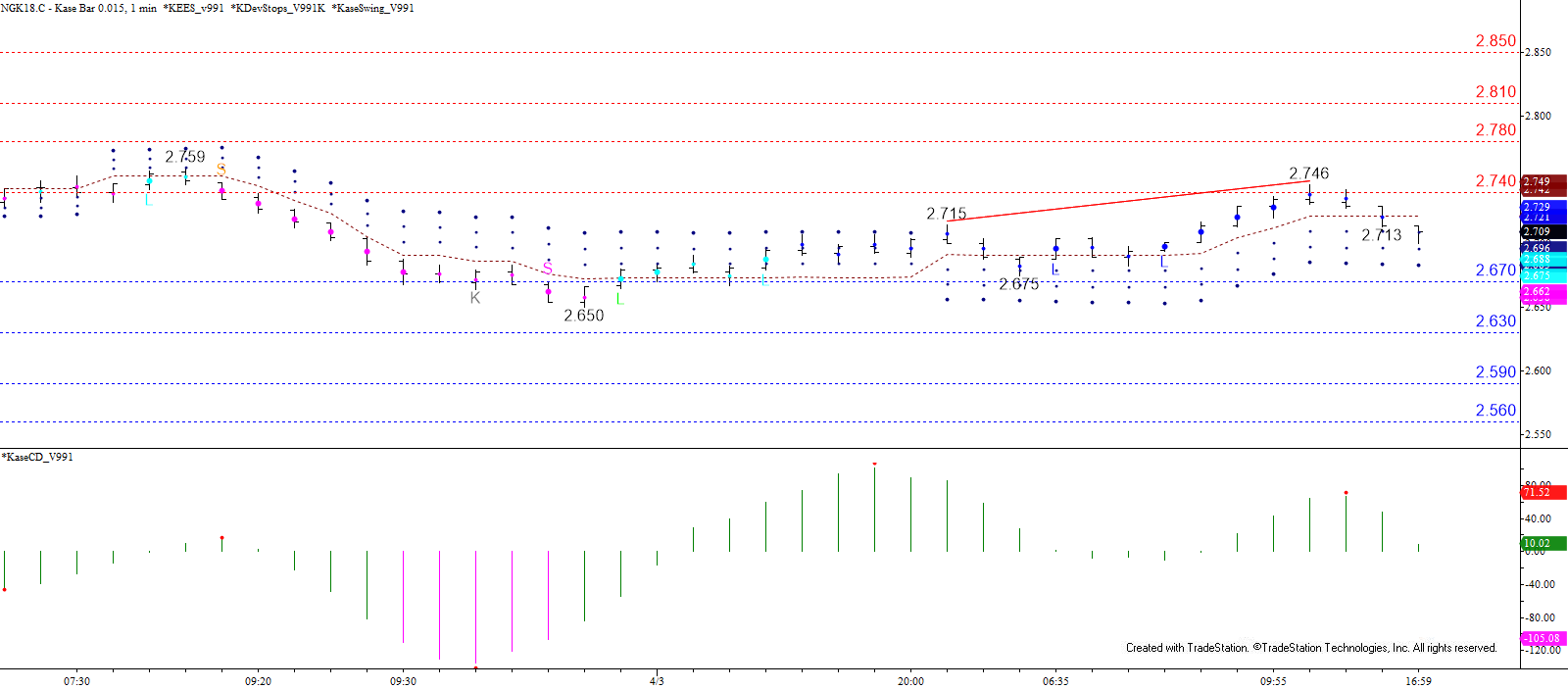

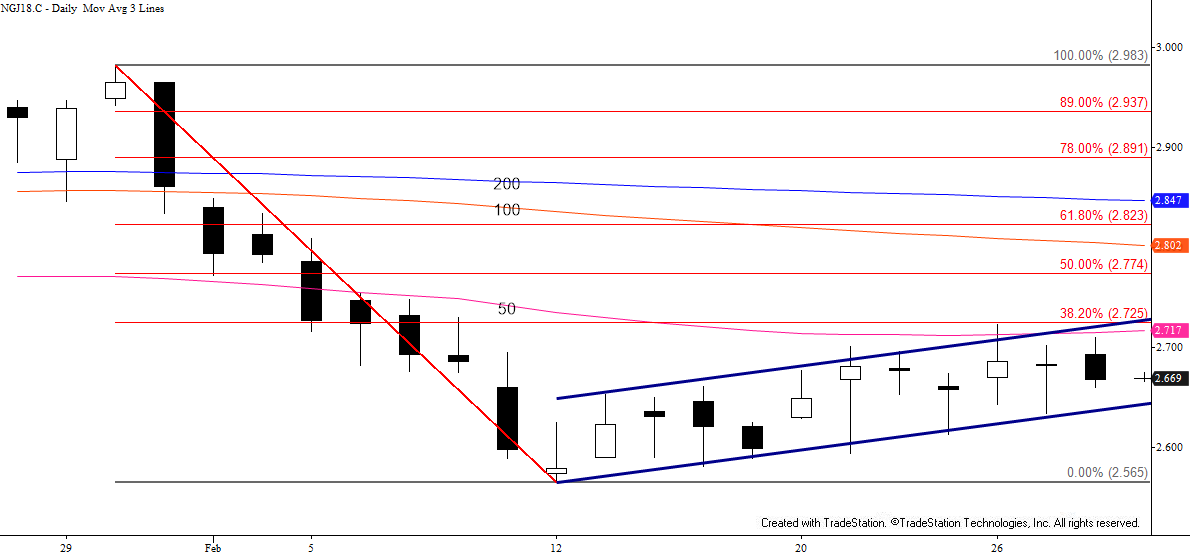

Prices briefly fell below the lower trend line of the bullish pennant (not a textbook example) that formed during the decline from $2.764. However, the move stalled at $2.621 before rising to $2.69 and forming an intra-day double-top. Due to this pattern and the settle below Tuesday’s midpoint and the 62 percent retracement of the decline from $2.726 near-term odds favor a test of $2.64 tomorrow. This is the intra-day double top’s target and the larger than target of the wave $2.69 – 2.667 – 2.69.

A close below $2.64 would call for $2.60 and lower, though given recent choppiness it would not be surprising to see $2.64 hold and for a test of $2.72 resistance to take place. This is near the upper trend line of the pennant. A close above this would call for $2.76 and possibly higher.

So, the market will most likely test a bit lower tomorrow before possibly challenging resistance again. But, with all factors considered, there is still no evidence that the market will break out of the trading range and determine a long-term direction.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.