Natural Gas Technical Analysis and Near-Term Outlook

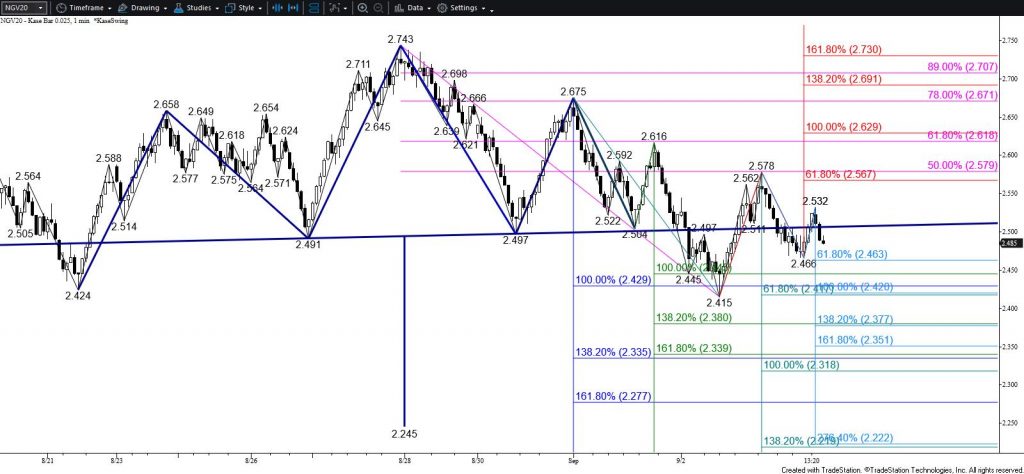

Natural gas rose to challenge important near-term resistance around $3.05 this afternoon. This is a confluent wave projection and the 38 percent retracement of the decline from $3.396. This is also a potential stalling point. However, today’s close above $3.03, the smaller than (0.618) target of the primary wave up from $2.821, calls for a test of $3.12 and possibly $3.18 during the next few days. The $3.12 objective is the equal to (1.00) target and 50 percent retracement. The $3.18 objective is the intermediate (1.382) target and 62 percent retracement. The latter objective is most important because settling above $3.18 would reflect a bullish shift in external factors (e.g. weather) and near-term sentiment.

Nevertheless, the move up is still corrective of the decline from $3.396 and also stalled near the 100-day moving average this afternoon. Additionally, because of the confluence and importance of resistance around $3.05, a test of $2.97 will probably take place first. Falling below this will call for key near-term support at $2.91. This is the 62 percent retracement of the rise from $2.821 and is in line with the $2.911 swing low. Taking out $2.91 will invalidate the wave up from $2.821 that calls for $3.12 and $3.18 and would shift odds back in favor of another test of $2.82 and likely lower.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.