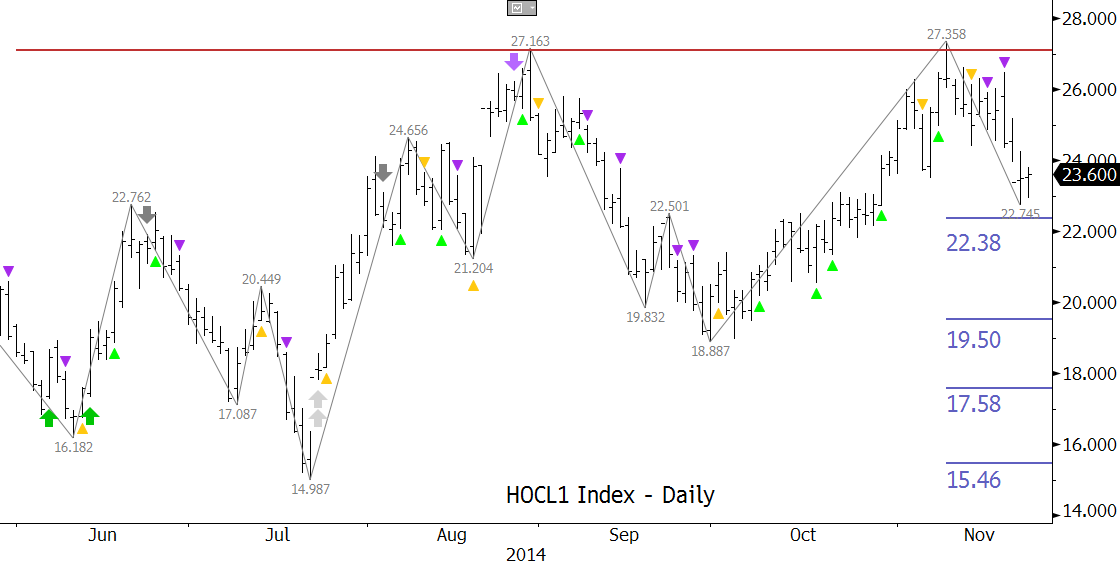

The HOCL crack spread has narrowed after forming a double top at $27.26. A close below the $18.887 swing low would confirm the pattern. KaseX also indicates the spread should narrow. However, the move may be corrective. Crucial support at $22.38 is the 62 percent retracement from $18.887 and the 38 percent retracement from $14.987. A close below $22.38 would call for $19.5; the last level protecting $18.887. Resistance at $25.6 is key. A sustained close over this would open the way for $31.14 and higher.

Please click the links for more information about KaseX and our energy forecasts.