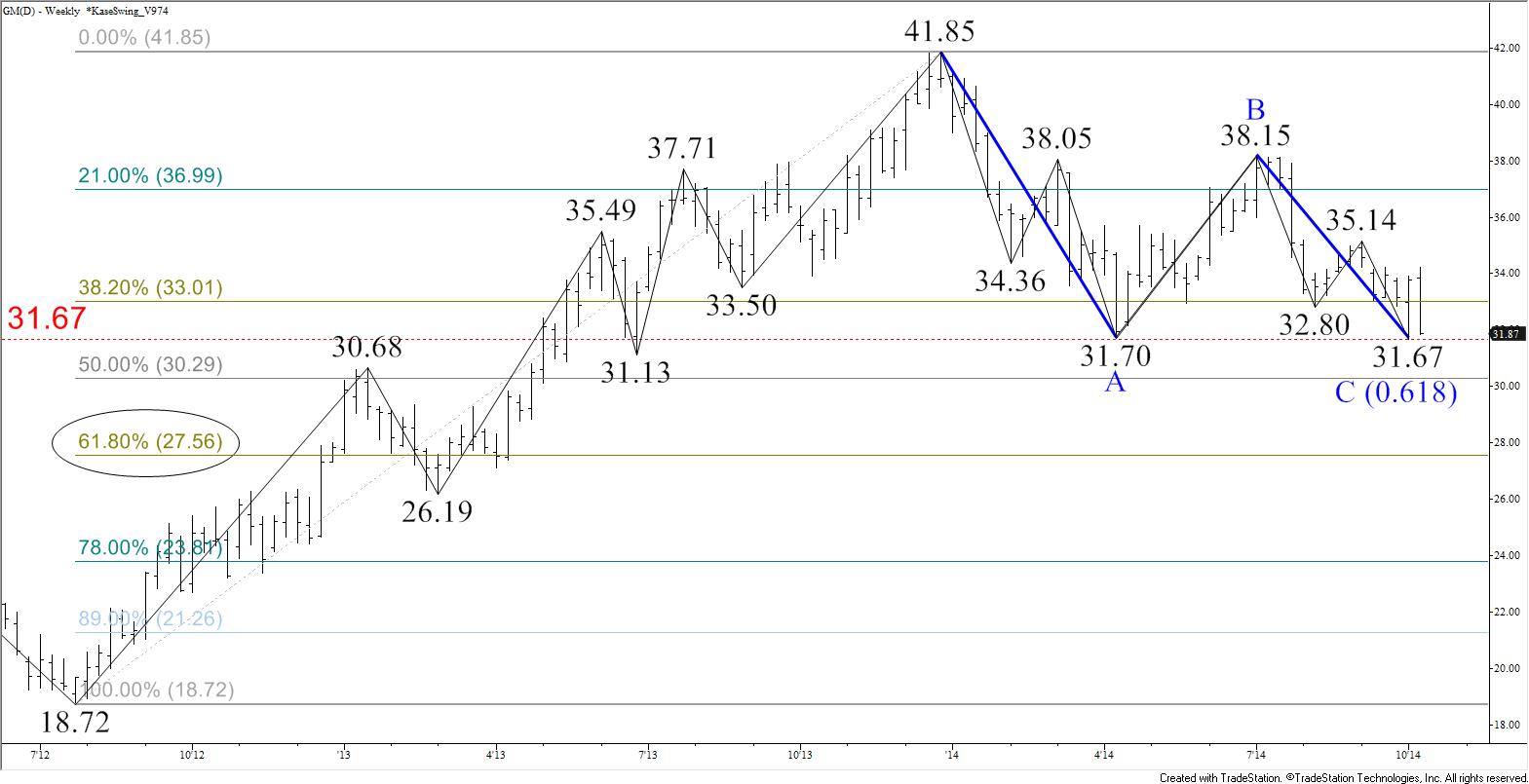

GM’s decline from $41.85 may be corrective longer term, but the recent $31.67 swing low fulfilled the 0.618 projection for Wave A, $41.85 – 31.7 – 38.15. This indicates the decline should continue because most waves that meet the 0.618 projection extend to at least the 1.00 projection, in this case, $28.0. This is near the 62 percent retracement of the move up from $18.72 to $41.85 at $27.56. These two factors, along with other sub-wave projections for the decline from $38.15, form a confluence point at $27.8. This is key target for the near-term and will likely be tested within the next few weeks. It is also a decision point for the longer-term. The confluence at $27.8 indicates it is a potential stalling point, but a weekly close below $27.8 would open the way for longer-term bearish objectives of $26.7, $24.0, and $21.8.

That said, a small double bottom may have formed at $31.67. This is a crucial area that has held so far, but October 7’s gap lower indicates $31.67 will not likely hold for much longer. Look for resistance at $34.2. The key level is $35.3. This is the 38 percent retracement from $41.85 to $31.67, and is in line with the 35.14 swing high. A close over this would call for an extended correction and attempt to confirm the double bottom with a close over $38.15. Confirming the double top would shift the long-term outlook to bullish and call for $44.6 and higher.

That said, a small double bottom may have formed at $31.67. This is a crucial area that has held so far, but October 7’s gap lower indicates $31.67 will not likely hold for much longer. Look for resistance at $34.2. The key level is $35.3. This is the 38 percent retracement from $41.85 to $31.67, and is in line with the 35.14 swing high. A close over this would call for an extended correction and attempt to confirm the double bottom with a close over $38.15. Confirming the double top would shift the long-term outlook to bullish and call for $44.6 and higher.