Natural Gas Technical Analysis and Near-Term Outlook

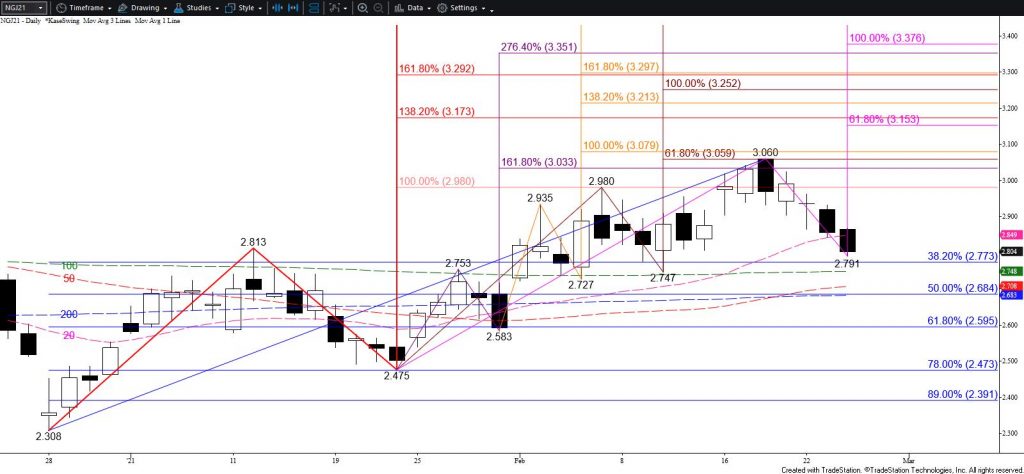

Natural gas continues to struggle to take out $2.62 and test the 62 percent retracement of the rise from $2.308 at $2.60. However, because the primary wave down from $3.06 has taken out its $2.66 smaller than (0.618) target, odds still favor an eventual decline to the $2.53 equal to (1.00) target. Falling below $2.65 before prices rise much higher will clear the way for a test of $2.60 and then $2.52 in the coming days.

With that said, today’s move up from $2.615 has challenged first resistance around $2.70, and there is a good chance for a test of $2.74 and even $2.79 tomorrow. Resistance at $2.74 is in line with the 10-, 50-, and 100-day moving averages and could prove to be a stalling point for the upward correction. However, $2.79 is more important. This is the 38 percent retracement of the decline from $3.06 and must hold for the near-term outlook to remain bearish.

Settling above $2.79 would not mean the move down is over. However, this would call for a test of $2.84 and possibly $2.89. The $2.89 level is the 62 percent retracement of the decline from $3.06 and is in line with the $2.887 swing high. Overcoming this would invalidate the primary wave down from $3.06 that projects to $2.53. Closing above $2.89 is currently doubtful but would reflect a bullish shift in external factors and call for a push toward $3.00 again.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.