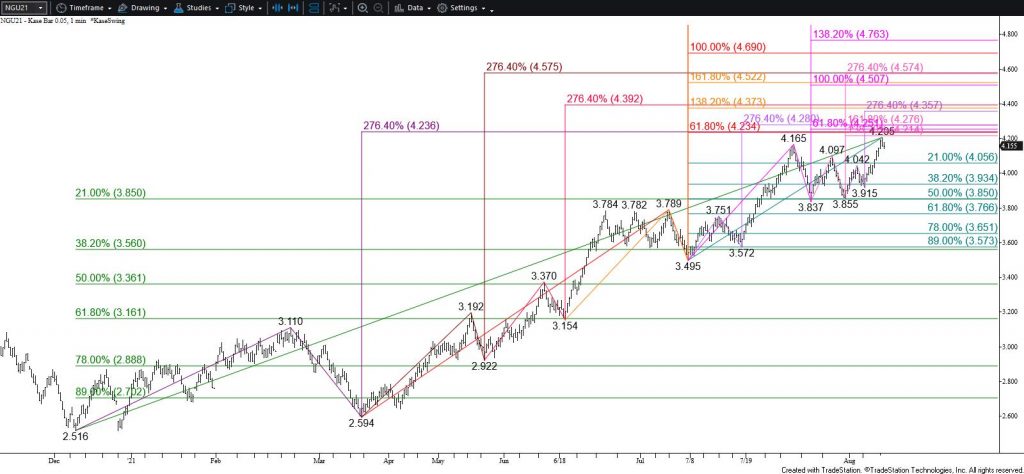

Natural Gas Technical Analysis and Near-Term Outlook

Natural gas rose to a new high of $4.205 and stalled just below the next major objective at $4.24. This is the most confluent target on the chart and a key projection for many of the largest and most important waves and subwaves up from the $2.516 swing low. Given the confluent and importance of $4.24, this could prove to be another stalling point. However, once met an eventual close above $4.24 is anticipated. Such a move will clear the way for a push toward $4.51 in the coming weeks.

With that said, while the pullback from $4.205 might have been profit-taking toward the end of the day the move warns that a test of at least $4.13 and possibly $4.06 could take place first. Without a sudden bearish shift in supply/demand factors, $4.06 is expected to hold. Key support and the barrier to a bearish near-term outlook is $3.98. Settling below $3.98 will clear the way for $3.93 and possibly $3.85 instead.

This is a brief analysis for the next day or so. Our weekly Natural Gas Commentary and daily updates are much more detailed and thorough energy price forecasts that cover key natural gas futures contracts, calendar spreads, the UNG ETF, and several electricity contracts. If you are interested in learning more, please sign up for a complimentary four-week trial.